Slicing its way through regulatory roadblocks 🎯

How is RBI shaping the future of India's this NBFC through its regulatory sandbox...

June 2022: RBI issues a circular to ban credit-line-backed prepaid cards. 😱

October 2022: Slice changes the way it operates. 💼

Quick Context: ⏮️

Startups like Slice, Uni Cards, and PostPe worked in the regulatory grey area challenging the position of the incumbents - credit cards issued by the Banks, by issuing credit lines on “Prepaid Cards”.

How do these startups operate? 🤖

For context, prepaid cards are just like your debit or credit cards with a value stored to purchase goods and services. However, they aren’t linked to any financial institutions and are just aligned with card networks like VISA or Mastercard.

Startups backed by leading global investors like Tiger Global, Sequoia Capital, and Accel investors, gave rise to a completely new version of the Buy Now Pay Later (BNPL) product, building it on top of the very habit of people swiping their cards.

Making BNPL available on cards has been revolutionary from the perspective of ease of use and has brought millions of “first-time” card users into the formal credit ecosystem.

Major Corrections: The RBI Memos and other factors.📜

June 2022: In June, RBI issues a circular preventing the loading of credit lines on Prepaid Instruments(PPIs). This landed a big blow, similar to the scale of “Demonization” to Indians, to the companies like Slice, Uni Cards, PostPe, Kissht, KreditBee, and Red Carpet who were issuing “credit lines” on PPIs and PayTM which was disbursing credit into customer’s wallet accounts.

August 2022: New digital lending guidelines were issued by RBI due to which loan disbursals and repayments could only be possible between the regulated lending entity’s bank account and the borrower, and not pass through any third party.

In simple terms, in the case of Slice, it would be SBM Bank issuing the loan to the user’s bank account directly, without Slice’s intervention.

What is the problem? 🧐

For starters, credit line-backed PPI cards are directly competing with the traditional credit cards issued by banks, lunching on their share.

How do traditional credit cards work? ⬇️

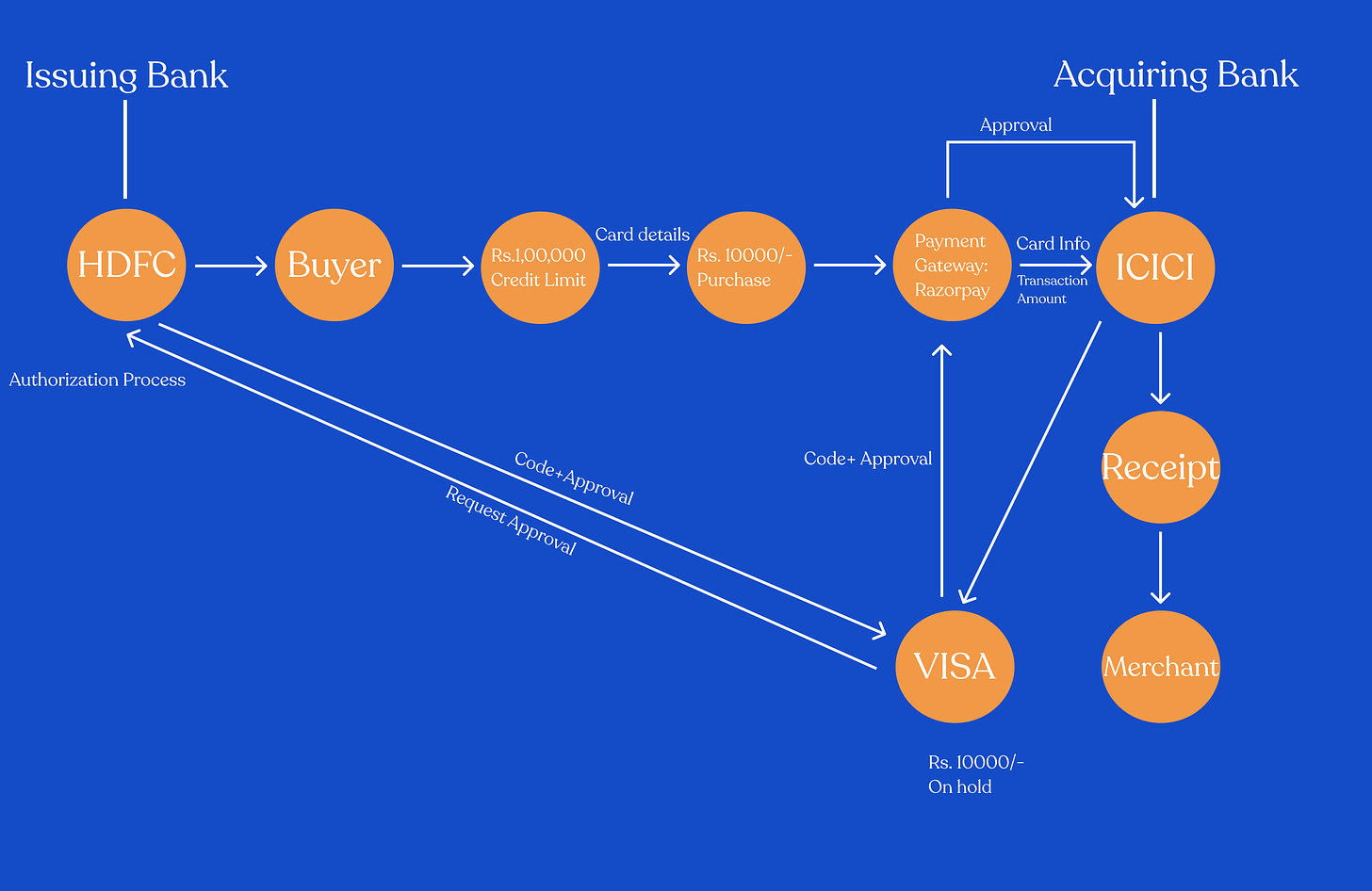

For the sake of better understanding, we will consider HDFC as the issuing bank and ICICI as the acquiring bank in this case study.

To understand why traditional credit card operators expressed their concern with RBI, let’s know the way they work:

HDFC issues the buyer a card with a credit limit of Rs. 1,00,000. When the user makes a purchase of Rs. 10,000/-, card details are processed to the payment gateway, which here is Razorpay.

Razorpay passes the card information and transaction amount to ICICI which the merchant chooses.

ICICI communicates with the card network, VISA, for the authorization process.

VISA initiates the authorization process with HDFC. In case, the card details aren’t correct, or there is insufficient balance, the transaction is declined; otherwise, the request is approved, and the code and approval are sent back to the card network provider.

VISA, in turn, sends the code and approval to the payment gateway, which is further sent to ICICI for approval. Here, VISA keeps RS. 10000/- on hold.

Once ICICI has received the approval, the receipt is sent to the merchant.

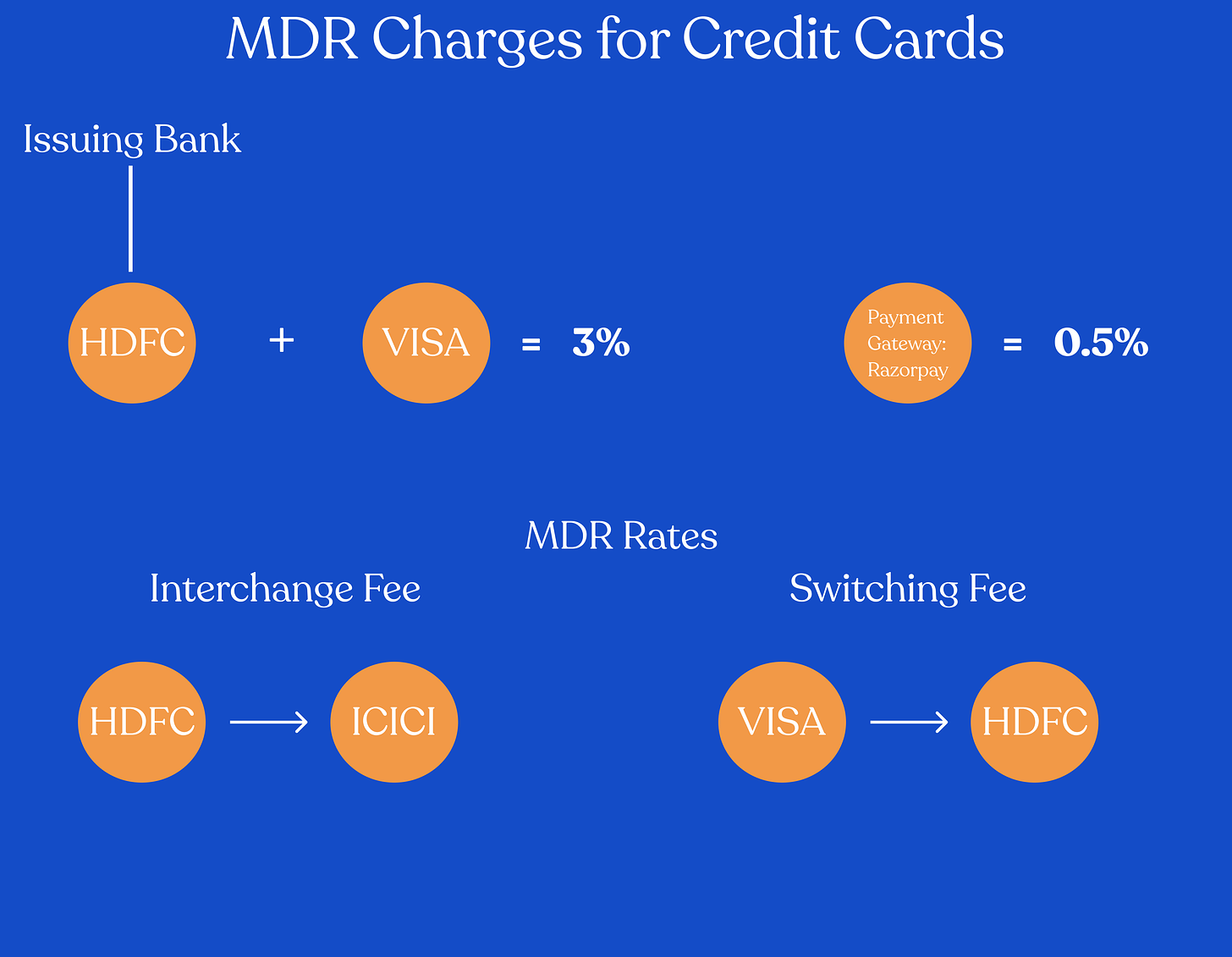

Fees are deducted from the amount merchant is to receive, which is referred to as the Merchant Discount Rate. The MDR charges for Credit Cards are 3%, to be paid to the issuing bank and the card network. Apart from this, the payment gateway charges a 0.5% fee.

The MDR rates include the following:

Interchange fee: Issuing bank charges Acquiring bank

Switching fee: The card provider network charges the Issuing bank

On the other hand, the charges for Debit Cards are about 0.9%.

How does a Credit-line-backed PPI work? ⬇️

Credit-line-backed PPIs pose as Debit Cards, given the way they function is “debiting” the amount from the balance available on the card. Now, this is an inherent behavior of a PPI. But the source of these funds is a credit line in the case of Slice. And that’s where the problem lies. Due to this, they can charge MDR rates similar to credit cards, and hence the merchants are liable to pay the Interchange fees, just like credit cards.

Interchange fees are the charges from the issuing bank to the acquiring bank.

How does an NBFC, let’s say Slice in this case benefit?

On every transaction, the issuing bank, which here in Slice’s case is the SBM bank, charges the interchange fees and Slice receives a minor cut from it. This may not be a major amount as multiple factors, including cashback and commissions to various stakeholders, are involved here. Then how does Slice profit?

Quantity of transactions.

And hence, the focus for Slice remains to make the customer spend more. The more the number of transactions, the more the amount spent, and the higher is profit.

But with the regulations kicking in, what’s next for Slice? ⏭️

Slice recently “re-branded” their product and launched three different offerings:

Slice Mini:

A prepaid account where users can load money through UPI, Debit Card, Netbanking, or Credit Card and the payments can be made using the Slice card, which now is positioned as a prepaid card for both offline and online payments.

The mini account can be linked with the “Slice UPI” and payments can be done using a card sourced through UPI.

For every payment, the users get rewarded with up to 2% cashback and are eligible for other offers through a feature called “Spark”.

Slice Borrow:

Allows the users to borrow money against a fee and they can pay it back within a month without paying any interest or split up repayments up to 12 months.

The amount allowed to borrow depends upon the purchasing power and has an upper cap of 5 lakh.

Slice UPI:

Essentially a way for Slice’s users to pay using UPI just like millions of UPI apps out there.

The value proposition here is users can pay through the linked mini account without the UPI pin and some other offers they promised to roll out.

That’s it. That’s the new product.

UPI has been there for about 6 years now.

So why even try to attempt it when players like PhonePe, GPay, and PayTm already exist in the market occupying a major share? 💎

The answer lies in Slice Mini. With Slice Mini, Slice creates a virtual wallet or a prepaid account for the users (obviously these are KYC-verified), which they can load using one of the methods like UPI, Debit Cards, Netbanking, and Credit Cards. The card will debit money for transactions from this account.

This move sorts out the issue about prepaid cards and RBI concerns, as no credit line is being loaded on a PPI. It is purely the user loading the account with their money. (This change adheres to the June RBI Note.)

Once the user requests money through the “Slice Borrow” feature, Slice intends to disburse the money directly to the user’s bank account, just like the traditional loans, cutting out its involvement and ensuring it is only SBM bank and the user’s bank interacting. (This change adheres to the August RBI Note.)

The idea is to set up UPI Auto Pay/ Mandate on the prepaid account and link it to the user’s bank account, which would mean, whenever the balance goes below a certain minimum, it is refilled (by a certain amount authorized by the user when e-signing the mandate) without the user having to enter any PIN.

Sounds familiar? Isn’t this what bank accounts do? So now, the only value proposition for the users to use Slice is the 2% cashback, it promises to provide and the spark offers. It is pretty thin ice to play the bets on.

According to the changes, now if the user needs credit, they will have to request it through the app, and that too for a fee. It is not a natural human behavior to do so. The earlier version, which enabled users to use the card without any additional actions leveraged the inherent user behavior and supplemented it with convenience.

From a 3-month free credit USP to borrowing at a fee, from seamless card swipe with credit facility on the go to loading a prepaid card with own money, a lot has changed at Slice. Only time will tell whether this will pan out for better or worse.

Share this story with your friends on WhatsApp

That's all for now ✨

Did the post add value to your thought process?

Subscribe to the ProductX newsletter 👇🏻